TOKYO, May 15, 2025– Astellas Pharma Inc. (TSE: 4503, President and CEO: Naoki Okamura, “the Company”) today announced that at the meeting of the Board of Directors held today, a resolution was passed to approve the details of the incentive plan (“Plan”) to be implemented in fiscal year 2025 based on the Performance-linked Stock Compensation Scheme (“Scheme”) for the Company’s Directors (excluding outside Directors and Directors who are Audit & Supervisory Committee Members; hereinafter “Directors”) as described below.

- Objective for the Scheme

(1) The Scheme is a medium- to long-term-based incentive plan, for the Directors that is highly transparent and objective, and closely linked with the Company’s enterprise and shareholder value with the aim of promoting management focused on increasing enterprise and shareholder value over the medium- to long-term.

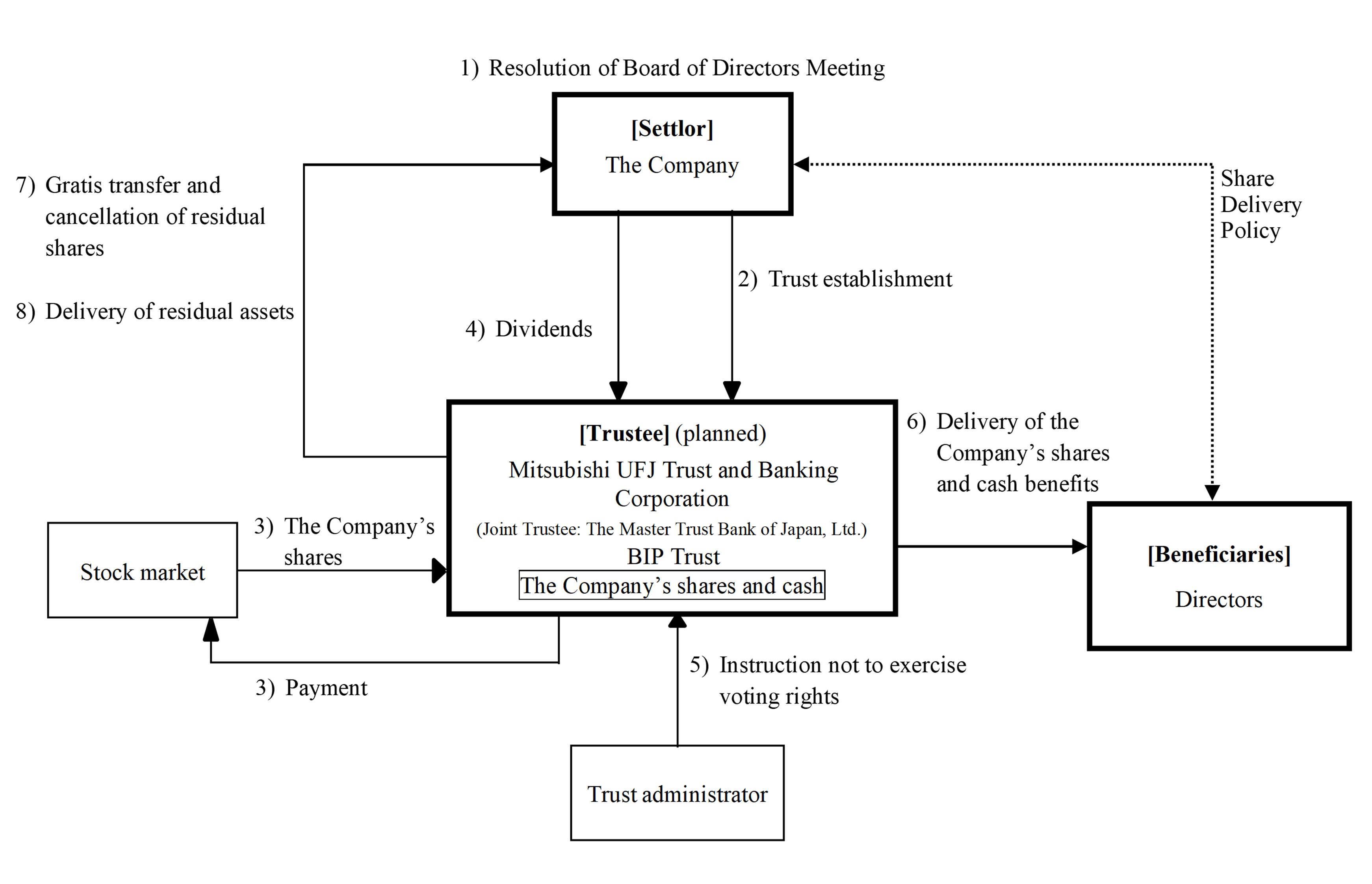

(2) The Scheme adopts a structure called the executive compensation BIP (Board Incentive Plan) trust (“BIP Trust”). BIP Trust is an executive incentive plan modeled on Performance Share and Restricted Stock systems in the U.S. The BIP Trust acquires the Company’s shares and conducts a “delivery of the Company’s shares” (as set forth in 3. (5) below; hereinafter the same) to the Directors based on the level of growth of enterprise and shareholder value, etc.

The Structure of the BIP Trust

1) Based on the Scheme, the Company shall resolve on the implementation and content of the Plan at the meeting of the Board of Directors.

2) The Company will put money in trust, to establish the BIP Trust, which will be the trust in which the beneficiaries shall be the Directors who have satisfied the beneficiary conditions (“Trust”). The money entrusted in the Trust shall be within the scope of approval of the 14th Term Annual Shareholders Meeting.

3) The Trust, in accordance with the instructions of the trust administrator, will use the money entrusted in 2) to acquire the Company’s shares on the stock market.

4) Dividends for the Company’s shares in the Trust will be paid in the same way as with other shares of the Company.

5) Voting rights are not to be exercised on the Company’s shares within the Trust throughout the trust period.

6) During the trust period, beneficiaries will receive delivery of the Company’s shares in accordance with the Company’s Share Delivery Policy.

7) In the event that residual shares remain at the expiration of the trust period mainly due to the extent to which enterprise and shareholder value have achieved growth during the trust period, the Trust will continue to be used as an incentive plan based on the Scheme by making changes to the trust agreement and additional entrustments (*1), or otherwise a gratis transfer of these residual shares will be made from the Trust to the Company, and upon acquiring these shares the Company plans to implement the cancellation of them by resolution of the Board of Directors.

8) Upon conclusion of the Trust, the residual assets remaining after allocation to the beneficiaries are to belong to the Company within the scope of the reserve fund for trust expenses after deductions for stock purchases from trust money. In the event that there remain residual assets beyond the scope of the reserve fund for trust expenses, such assets are to be donated to an organization having no relationship of interest with the Company or Directors and Corporate Executives of the Company.(*1) As the Plan are the same kind of incentive plan as the Performance-linked Stock Compensation Scheme introduced in fiscal year 2015, the existing BIP for the Company’s Directors that was established in fiscal year 2022 will continue to be used.

Details of the Plan

(1) Overview of the Plan

The Plan is an incentive plan, under which delivery of the Company’s shares will be conducted during the three-year period from the fiscal year ending March 31, 2026 to the fiscal year ending March 31, 2028 (“Applicable Period”), based on the level of growth of enterprise and shareholder value, etc.

The Company intends to continue implementing incentive plans which are similar to the Plan in each year in and after the following fiscal year by establishing new BIP Trusts, or by making changes or additional entrustments to the existing BIP Trusts that have expired. The details of incentive plans put into effect next fiscal year or later shall be determined at the appropriate time by resolution of the Board of Directors.

(2) Individuals eligible under the Plan (Beneficiary Conditions)

The Directors who are in office as of July 1, 2025 (“Eligible Individuals”) will, in principle, receive delivery of a certain number of the Company’s shares based on the points provided for below in (4) subject to the condition that the Beneficiary Conditions set forth below are satisfied.

The Beneficiary Conditions are as follows:

1) Such person shall continue to serve as the Director until June 1, 2028;

2) Such person shall have met other criteria which are deemed necessary for achieving the purpose of the stock compensation scheme.

(3) Trust period

The trust period shall be from May 21, 2025 (planned) to August 31, 2028 (planned).

At the expiration of the trust period, the Company may continue the Trust in the form of incentive plans which are similar to the Plan by making changes to the trust agreements and making additional entrustments.

(4) Number of the Company’s shares to be delivered to Eligible Individuals

The number of the Company’s shares to be delivered to Eligible Individuals (including the number of the Company’s shares to be converted into cash in accordance with (5) below) shall be determined on the basis of the points, which have been allocated in accordance with the following, with 1 point corresponding to 1 share of the Company’s share (*2).(*2) In the event that the number of the Company’s shares belonging to the Trust increases or decreases due to stock split, gratis allotment or stock consolidation, etc., the number of the Company’s shares to be delivered per point shall be adjusted by means of a reasonable method.

Basic points shall be allocated to the Eligible Individuals who are in office as of July 1, 2025 in accordance with the following formula.

(Formula for the calculation of basic points)

Basic amount (*3) determined based on rank divided by the Average closing price of the Company’s shares on the Tokyo Stock Exchange in March 2025

* Any fractions of less than one shall be discarded.(*3) The basic amount levels shall be set appropriately in accordance with responsibilities and other factors in reference particularly to objective remuneration survey data of an external expert organization in order to ensure competitive remuneration levels that enable the Company to recruit and retain talents.

Eligible Individuals who are in office as of June 1, 2028 will receive delivery of the Company’s shares from the Trust in numbers corresponding to the points calculated according to the formula below.

Basic points × Performance-linked coefficient (*4)

* Any fractions of less than one shall be discarded.(*4) The performance-linked coefficient of the Plan shall be determined within a range from 0% to 200% based on results of comparing the Company’s total shareholder return (“TSR*”) during the applicable period, against both the growth rate of Tokyo Stock Price Index (TOPIX) and the TSR of global pharmaceutical companies (“TSR Peer Group”). The list of the TSR Peer Group shall be proposed to the Board of Directors after deliberation by the Compensation Committee, and accordingly determined by June 30, 2025.

* TSR refers to shareholders’ total return on investment, encompassing both capital gains and dividends.(5) Method and timing for delivering the Company’s shares to the Directors

“Delivery of the Company’s shares” refers to, at a given time, the receipt of half of the number of the Company’s shares corresponding to the allocated points from the Trust (provided that shares less than one unit shall be converted into cash within the Trust and the cash equivalent to the amount of conversion will be received), and the receipt of the cash equivalent to the remaining half after conversion into cash within the Trust.

Eligible Individuals who have met the Beneficiary Conditions will receive delivery of the Company’s shares around June 2028.

In the event that an Eligible Individual retires during the trust period (excluding voluntary retirement and dismissal), as a general rule, such individual will receive the delivery of the Company’s shares in numbers corresponding to the points that have been allocated up to the time of retirement.

In the event that an Eligible Individual becomes deceased during the trust period, as a general rule, the Company’s shares shall be converted into cash in numbers corresponding to the points which have been allocated to such individual up to that time within the Trust, and the cash equivalent to the amount of conversion will be received by such individual’s heir from the Trust.

(6) Amount expected to be entrusted to the Trust and the number of the Company’s shares expected to be delivered from the Trust (including the number of the Company’s shares to be converted into cash in accordance with (5) above).

The Company intends to entrust ¥1,040 million to the Trust (*5).(*5) Equivalent to the total amount of stock purchases, trust fees and trust expenses during the trust period, and inclusive of the residual assets succeeded from the existing BIP Trust. At the 14th Term Annual Shareholders Meeting, it was approved and resolved the maximum amount of contribution to the Scheme to be ¥1,640 million per fiscal year, and the amount to be entrusted by the Company to BIP Trust in each fiscal year shall be within the amount thus resolved.

The maximum number of the Company’s shares to be delivered by the Trust during the trust period in accordance with (4) above shall be the number derived by dividing maximum amount of ¥1,640 million entrusted to the Trust by the average closing price of the Company’s shares on the Tokyo Stock Exchange in March 2025.

(7) Malus Clause and Clawback Clause

The Company stipulates in the rules regarding remunerations for Directors a Malus Clause that forfeits the right to receive delivery of the Company’s shares by resolution of the Board of Directors in the event of misconduct, etc. by Eligible Individuals and the Company stipulates a Clawback Clause in the rules regarding remunerations for Directors, which allows the Company to demand the return of the amount equivalent to the number of Company’s shares delivered to Eligible Individuals by resolution of the Board of Directors in the event of post-financial restatement due to material accounting errors or fraud, or in the event of misconduct, etc., by Eligible Individuals. The remuneration that may be subject to reimbursement are part or all of the amount equivalent to the number of Company’s shares delivered, for the target period that includes the fiscal year in which such event occurred and the three preceding fiscal years.

(8) Method for acquiring the Company’s shares by the Trust

The acquisition of the Company’s shares by the Trust is planned to be made on the stock market.

(9) Exercise of voting rights of the Company’s shares within the Trust

In order to maintain a neutral position vis-a-vis management, no voting rights shall be exercised on the Company’s shares within the Trust during the trust period.

(10) Handling of dividends on the Company’s shares within the Trust

Dividends on the Company’s shares within the Trust shall be received by the Trust and applied to trust fees and trust expenses for the Trust.

(11) Handling at the expiration of the trust period

In the event that residual shares remain at the expiration of the trust period due to factors such as the extent to which enterprise and shareholder value have achieved growth during the applicable period, the Company may continue the Trust in the form of incentive plans which are similar to the Plan by making changes to the trust agreement and additional entrustments. If the Trust is to be terminated due to the expiration of the trust period, gratis transfer of these residual shares will be made from the Trust to the Company, and the Company plans to implement the cancellation of them by resolution of the Board of Directors.

Additionally, in the event that residual dividends on the Company’s shares within the Trust remain at the expiration of the trust period and the Company continues to use the Trust, such residual assets shall be applied towards the acquisition of shares. However, if the Company concludes the Trust due to the expiration of the trust period, such assets are planned to be donated to an organization having no relationship of interest with the Company or Directors and Corporate Executives of the Company.

(Reference)

[Contents of the Trust for the Incentive Plan in fiscal year 2025]

| 1) Trust category | Monetary trust other than a specific individually operated monetary trust (third-party benefit trust) |

| 2) Trust objective | To provide incentive to the Directors |

| 3) Settlor | The Company |

| 4) Trustee | Mitsubishi UFJ Trust and Banking Corporation (planned) (Joint Trustee: The Master Trust Bank of Japan, Ltd.) |

| 5) Beneficiaries | The Directors who have satisfied the Beneficiary Conditions |

| 6) Trust administrator | Third party with no relationship of interest with the Company (certified public accountant) |

| 7) Date of trust agreement | May 21, 2025 (planned) |

| 8) Trust period | May 21, 2025 (planned) to August 31, 2028 (planned) |

| 9) Start of the Plan | July 1, 2025 (planned) |

| 10) Exercise of voting rights | Not to be exercised |

| 11) Type of shares to be acquired | Common stock of the Company |

| 12) Amount of entrustment | ¥1,040 million (planned) (Including trust fees and trust expenses) (*6) |

| 13) Acquisition period of shares | May 23, 2025 (planned) to June 30, 2025 (planned) |

| 14) Method of acquiring shares | Acquisition on the stock market |

| 15) Rights holder | The Company |

| 16) Residual assets | The Company, the rights holder, will receive residual assets within the scope of the reserve fund for trust expenses after deductions of stock purchases from trust money. |

(*6) The above amount of trust includes the residual assets succeeded from the existing BIP Trust.

About Astellas

Astellas is a global life sciences company committed to turning innovative science into VALUE for patients. We provide transformative therapies in disease areas that include oncology, ophthalmology, urology, immunology and women's health. Through our research and development programs, we are pioneering new healthcare solutions for diseases with high unmet medical need. Learn more at www.astellas.com.

Cautionary Notes

In this press release, statements made with respect to current plans, estimates, strategies and beliefs and other statements that are not historical facts are forward-looking statements about the future performance of Astellas. These statements are based on management’s current assumptions and beliefs in light of the information currently available to it and involve known and unknown risks and uncertainties. A number of factors could cause actual results to differ materially from those discussed in the forward-looking statements. Such factors include, but are not limited to: (i) changes in general economic conditions and in laws and regulations, relating to pharmaceutical markets, (ii) currency exchange rate fluctuations, (iii) delays in new product launches, (iv) the inability of Astellas to market existing and new products effectively, (v) the inability of Astellas to continue to effectively research and develop products accepted by customers in highly competitive markets, and (vi) infringements of Astellas’ intellectual property rights by third parties.

Information about pharmaceutical products (including products currently in development) which is included in this press release is not intended to constitute an advertisement or medical advice.

Click below for a copy of the full press release