Astellas' status in Action to Implement Management that is Conscious of Cost of Capital and Stock Price is as follows.

Analysis of

Current Situation | - Recognized that awareness of cost of capital and stock price is essential for sustainable growth and increased corporate value

- Aiming to ensure return on capital in excess of cost of capital, WACC is calculated and verified on a regular basis and used in business investment decision-making after a clear assessment of the cost of capital

- On the other hand, it is recognized that stock prices in the pharmaceutical sector are heavily influenced by business performance and the future pipeline value

- Implement management based on the evaluation of future pipeline value as an indicator to realize medium- and long-term corporate value enhancement, rather than capital profitability indicators such as ROE and ROIC, which are calculated as actual values for a single fiscal year

|

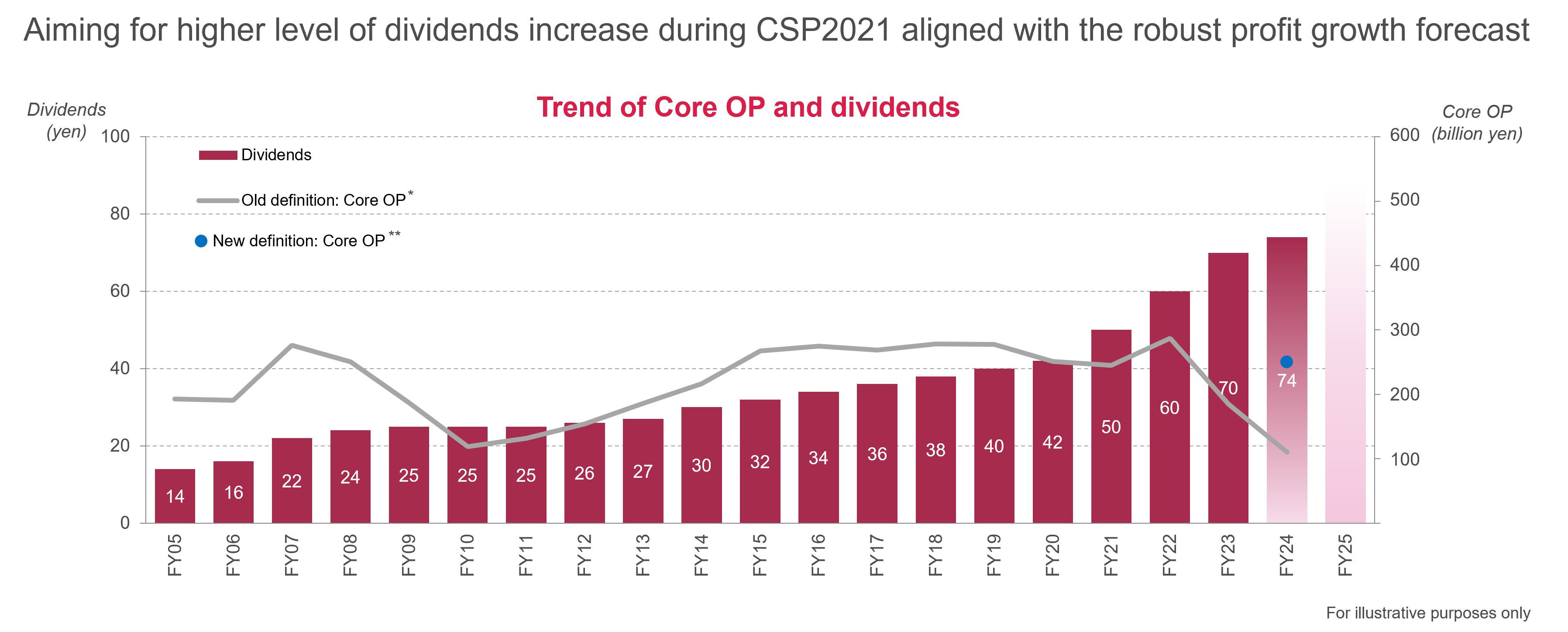

| Planning | - A medium-term plan “Corporate Strategic Plan 2021” was announced in May 2021. The Performance Goals set are ‘Revenue', ‘Pipeline Value' and ‘Core Operating Profit Margin’

- Aspire to be recognized as a company with a market capitalization exceeding 7 trillion yen by achieving the Performance Goals above

- Revised and disclosed capital allocation policy in line with Corporate Strategic Plan 2021 (see figure below for details)

- When opportunities for capital investment to realize future growth are identified, raise funds as necessary, while carefully assessing and managing the appropriate level of capital reserves

- Maintain a balanced capital structure necessary to ensure future cash flows and a stable operational foundation when implementing large-scale acquisitions

|

| Initiatives | - Adopt Performance-linked Stock Compensation Scheme (measurement index: TSR*) as medium- to long-term incentive remuneration for Directors and Top Management, and establish a system that contributes to the enhancement of corporate value and shareholder value

- Review the corporate value (theoretical value) calculated from the "pipeline value" and other factors on a regular basis, monitor progress, and implement business decisions necessary for enhancing corporate value

- When making business investments, evaluate them by calculating NPV using the DCF method with WACC, and make decisions aimed at achieving a return that exceeds the cost of capital

- To achieve appropriate market valuation and share price, including future growth potential, and to reduce the cost of capital, promote proactive investor relations activities to engage with investors and enhance comprehensive information disclosure

- In accordance with the capital allocation policy, raise the dividend level aligned with profit / cashflow plan and actual performance, and flexibly execute share buybacks

- In accordance with the increase in interest-bearing debt associated with the acquisition of Iveric Bio, carry out appropriate debt management with a focus on cash flow and aim to promptly restore financial soundness

|

*: Total Shareholder Return. Total investment yield for shareholders, including capital gains and dividends

Capital Allocation

CSP: Corporate Strategic Plan,

*Prior to FY2012, operating profit is in accordance with J-GAAP, **Change in definition of core basis From FY2024(In addition to the old definition’s adjustments, “Amortisation of intangible assets”, “Gain on divestiture of intangible assets” and “Share of profit (loss) of investments accounted for using equity method” have been newly excluded as new adjustment items)